Los Angeles' new wealth tax could be a model for broke blue cities across America

Will blue states see this as the next pathway to redistributing wealth?

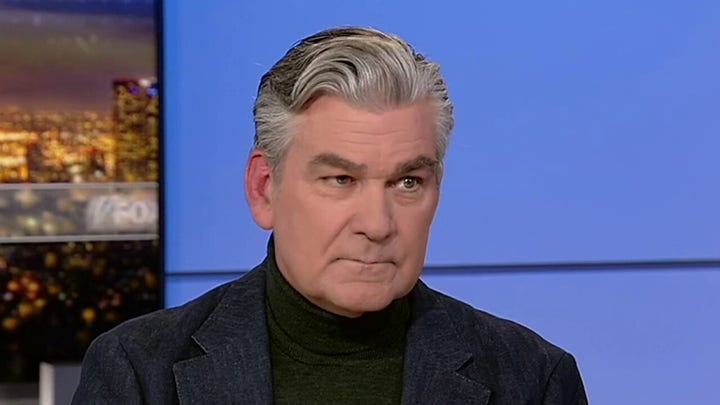

Dean Cain explains why he chose to move out of California

Dean Cain told Fox News Digital why he was one of many celebrities making the move from California to Nevada.

Exercise caution! California is unveiling a novel strategy for wealth distribution, prompting concern about its potential replication in other states.

Despite being the most heavily taxed state in the United States, California finds itself grappling with a staggering $68 billion budgetary deficit. Contrary to the metaphorical richness associated with the Gold Rush era, California's fiscal situation resembles Fool's Gold.

Even Gov. Gavin Newsome couldn’t admit in his recent debate against Florida Gov. Ron DeSantis that the net migration out of California is reaching epic proportions more often than not over one word… TAXES.

Los Angeles' mansion tax imposes an additional 4% tax on homes exceeding $5 million and a 5.5% tax on those surpassing $10 million paid for by the buyer. (iStock)

The city of Los Angeles and the legislators responsible for California's financial quagmire have devised a fresh tactic within the confines of the conventional playbook. Their query: How can the affluent be subjected to further taxation? How do we squeeze more out of the top 1%? How do we penalize those that are building wealth and want to buy a more upscale home?

NEW YORK, CALIFORNIA LOST MORE TAX INCOME THAN EVERY OTHER STATE AS PEOPLE FLED LIBERAL ENCLAVES

Considering that a high-income earner in California already endures a 37% federal tax, 13.3% state tax, and additional burdens like Social Security and Medicare, such individuals essentially toil for the state and federal government for seven to eight months annually.

Enter Los Angeles' latest stratagem, instated on April 1, 2023 – the "mansion tax." This levy imposes an additional 4% tax on homes exceeding $5 million and a 5.5% tax on those surpassing $10 million paid for by the buyer.

To illustrate, a $10 million property sale would incur customary 6% selling fees to a real estate agent. However, the purchaser must contend with the mansion tax, necessitating an additional $550,000 in addition to the sale price of the home. This not only intensifies the tax burden on the affluent but also has the potential to depress property values, making acquisitions financially elusive.

This double whammy affects not only those capable of affording such opulent residences but could reverberate across states, given the trend of rules being adopted at the $1 million threshold in various regions. With the median price of homes at roughly $400,000 across America, how soon will it be before every buyer pays a redistribution… err… a mansion tax?

What should make you worried is that California isn't alone in this trend, as several states have embraced similar measures to extract more revenue from property owners. Presently, six other states impose a mansion tax:

- Connecticut: 2.25% on properties surpassing $2.5 million.

- District of Columbia: 1.45% on properties sold for $400,000 or more.

- Hawaii: Marginal rates ranging from 10% to 20% for estates valued over $5.49 million.

- New Jersey: 1% on real estate transactions exceeding $1 million.

- New York: 1% to 3.9% on residential acquisitions of $1 million or more.

- Vermont: 16% on properties valued over $5 million.

- Washington: Graduated rates starting at 1.28% for properties sold at a minimum of $500,000.

The real question will be whether blue states across the country see this as the next pathway to redistributing wealth from those who own higher than average dollar real estate.

CLICK HERE FOR MORE FOX NEWS OPINION

As you strive and accumulate resources to potentially secure your dream home and your financial future, be on alert, particularly in states adhering to a blue political ideology as they may unveil yet another method akin to a Las Vegas casino.

It’s designed to do one thing and one thing only. Separate you from your hard-earned money. If your state hasn't embraced the mansion tax to date, exercise vigilance, as it may loom on the horizon.

Ted Jenkin is CEO and co-founder of Oxygen Financial.